In today’s unpredictable world, insurance serves as a financial lifeline, a safety net to shield you and your loved ones from the unexpected twists and turns that life can throw your way. From safeguarding your health and home to securing your vehicle and investments, insurance is the cornerstone of financial stability and peace of mind.

Let’s delve into the world of insurance, demystify the jargon, and understand why it’s not just another monthly expense but a crucial investment in your future.

Why Insurance Matters

- Financial Security: Insurance offers financial protection by covering expenses related to accidents, illnesses, property damage, or even the loss of a loved one. It prevents you from depleting your savings when disaster strikes.

- Legal Requirement: In many cases, insurance is not just a choice; it’s mandatory. Auto insurance, for instance, is required by law in most places. Failure to comply can lead to legal penalties.

Types of Insurance Policies

- Health Insurance: Your health is your most valuable asset. Health insurance ensures that you can access quality medical care without the burden of exorbitant costs.

- Life Insurance: It provides financial support to your family in the event of your untimely demise, ensuring they are taken care of.

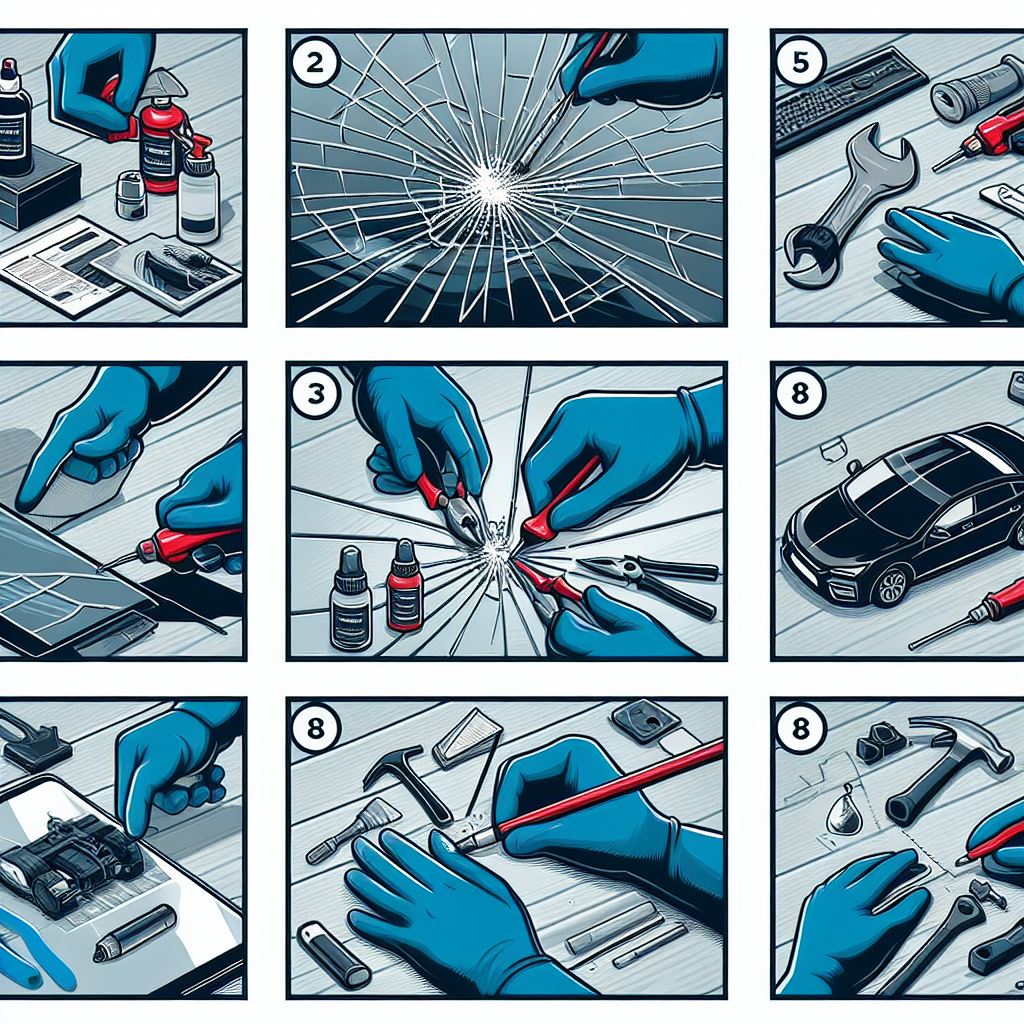

- Auto Insurance: Whether it’s a fender-bender or a major accident, auto insurance covers the damages and legal liabilities.

- Home Insurance: Protect your sanctuary. Home insurance covers damages to your property caused by disasters, theft, or vandalism.

- Travel Insurance: When life’s adventures take you abroad, travel insurance offers coverage for trip cancellations, medical emergencies, and lost luggage.

Insurance Myths Unveiled

- It’s Too Expensive: The cost of insurance varies, and there are affordable options. Moreover, it’s a safeguard against much higher potential expenses.

- I’m Young and Healthy; I Don’t Need It: Insurance is about planning for the unexpected. It’s better to secure policies while you’re in good health and premiums are lower.

- All Policies Are the Same: Different policies offer varying coverage and benefits. Tailor your insurance to your unique needs.

How to Get the Best Coverage

- Assess Your Needs: Determine what aspects of your life and assets need protection. This will guide your choice of insurance policies.

- Shop Around: Compare quotes from different insurers to find the best deals. Online tools can simplify this process.

- Understand the Fine Print: Don’t skim through the policy documents. Read and understand what is covered, what’s not, and any limitations.

- Combine Policies: Bundling multiple policies with one insurer can often lead to discounts and lower premiums.

Insurance and Your Future

By investing in insurance, you’re not just safeguarding against potential pitfalls; you’re actively building a more secure future for yourself and your loved ones. When life throws its curveballs, insurance ensures you can face them head-on without being blindsided by financial hardship.

The journey to insurance enlightenment starts with understanding your needs, exploring your options, and taking proactive steps to protect what matters most. The path to financial security is clearer when you have the right insurance by your side.