The Credit Information Bureau (India) Limited, also known as CIBIL, is the leading credit bureau in India that maintains credit information for individuals and companies. Most financial institutions rely on CIBIL scores to evaluate the creditworthiness of their potential borrowers. Therefore, it is crucial to maintain a good CIBIL score to avail of credit facilities at favorable terms.

Check CIBIL Score in Google Pay: Your Ultimate Guide

What is a CIBIL score?

The CIBIL score is a three-digit numerical representation of an individual’s creditworthiness. It is calculated based on the credit history and repayment behavior of the borrower. The score ranges between 300 and 900, with a higher score indicating lower credit risk.

The CIBIL score is based on factors such as credit history, outstanding debts, credit utilization, and past repayment behavior. The higher your score, the better your chances of getting a loan or credit card on favorable terms.

CIBIL score in Google Pay:

Google Pay, the digital payment app by Google, now offers a feature to check CIBIL scores for its users. This feature offers a convenient and secure way to access your CIBIL score on your mobile phone. Here we discuss how to check your CIBIL score in Google Pay, what it means, and how much of a score is considered good.

Can I check my CIBIL score in Google Pay? (How to Check CIBIL Score in Google Pay)

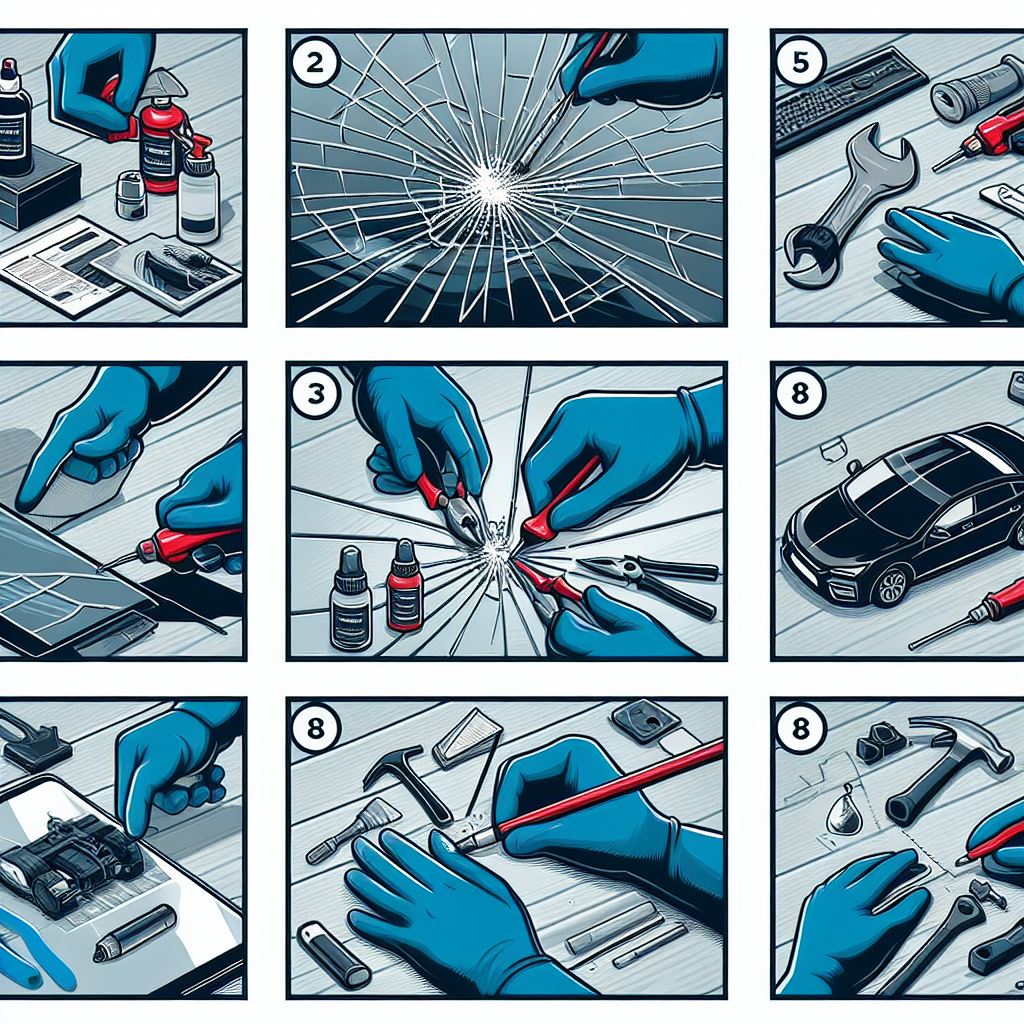

Yes, you can check your CIBIL score in Google Pay if you have a CIBIL account. To access your CIBIL score on Google Pay, follow the steps below:

Step 1:Install Google Pay.

If you don’t already have the Google Pay app on your smartphone, download it from your app store and set it up.

Step 2: Link Your Bank Account

To access your CIBIL score, you’ll need to link your bank account to Google Pay. This ensures that your financial information is accurate and up-to-date.

Step 3:Access the CIBIL Score Feature:

Once your bank account is linked, open the Google Pay app. Look for the “CIBIL Score” or “Credit Score” option in the menu. It may be located under the “Payments” or “Finance” section.

Step 4: Verify Your Identity:

To protect your CIBIL score information, Google Pay may require you to verify your identity. This can be done through various methods, such as entering your mobile number, date of birth, or linking your Google account.

Step 5: View Your CIBIL Score

After completing the verification process, you’ll be able to view your CIBIL score directly within the Google Pay app. It will typically be displayed as a three-digit number, along with an explanation of what that score means.

Is it safe to check your CIBIL score in Google Pay?

Yes, it is safe to check your CIBIL score in Google Pay. Google Pay uses robust security features, such as encryption and multi-factor authentication, to protect the user’s CIBIL account and personal information. Also, Google Pay does not store the user’s CIBIL account details or credit report on its servers.

Here are some reasons why it’s safe:

- Data Encryption: Google Pay uses encryption technology to safeguard your personal and financial information. This means that your CIBIL score data is transmitted and stored securely.

- Authentication: To access your CIBIL score in Google Pay, you’ll typically need to authenticate your identity through a secure PIN or other verification methods. This ensures that only authorized individuals can view your credit score.

- Privacy Controls: You have control over who can access your CIBIL score. Google Pay allows you to keep your financial information private and only share it with trusted parties.

- Trusted Platform: Google Pay is a well-established and widely used platform, making it a trusted choice for accessing your financial data.

What Does the CIBIL Score in Google Pay Mean?

The CIBIL score in Google Pay refers to the ability to access and monitor your CIBIL score directly through the Google Pay app. The Credit Information Bureau India Limited (CIBIL) is one of the leading credit bureaus in India, responsible for maintaining credit histories and generating credit scores for individuals and businesses. Your CIBIL score is a three-digit number that reflects your creditworthiness and financial health.

How much of a CIBIL score is good?

A CIBIL score of 750 and above is considered good by most lenders. A higher CIBIL score increases the chances of getting credit facilities at the lowest interest rates and on favorable terms. It also indicates that the borrower has good repayment behavior and is less likely to default on payments.

On the contrary, a low CIBIL score may lead to the rejection of loan applications or unfavorable credit terms. Therefore, it is crucial to maintain a good CIBIL score by practicing good financial habits such as timely repayment of debts and low credit utilization.

Here’s a breakdown of what different score ranges generally indicate:

- 300–549: Poor: Individuals with scores in this range may find it challenging to secure loans or credit cards. If approved, they may face high interest rates.

- 550-649: Fair: While individuals in this range have slightly better prospects, they may still encounter difficulty obtaining credit and face higher interest rates.

- 650-749: Good: A good CIBIL score in this range indicates a healthier credit profile. Borrowers are more likely to be approved for loans and credit cards at reasonable interest rates.

- 750-900: Excellent: Scores in this range are considered excellent. Borrowers can access credit easily and typically enjoy the best interest rates and terms.

Why should you check your CIBIL score?

Now that you know how to check your CIBIL score in Google Pay, you might be wondering why it’s important to do so. Here are some compelling reasons:

- Loan Eligibility: Your CIBIL score significantly influences your eligibility for loans and credit cards. Lenders use this score to assess your creditworthiness and determine the risk of lending to you.

- Interest Rates: A high CIBIL score can help you secure loans at lower interest rates. On the other hand, a low score may result in higher interest rates, making borrowing more expensive.

- Credit Card Approvals: When applying for a credit card, your CIBIL score is a key factor that lenders consider. A good score increases your chances of approval.

- Renting a property: Landlords often check the CIBIL scores of prospective tenants to assess their financial responsibility. A good score can make it easier to secure a rental property.

- Negotiating Power: A strong CIBIL score gives you negotiating power when dealing with lenders. You can leverage your good credit to negotiate better terms and conditions for loans and credit cards.

Checking your CIBIL score in Google Pay is a convenient and secure way to stay on top of your financial health. It’s crucial to monitor your CIBIL score regularly to ensure that it accurately reflects your creditworthiness.